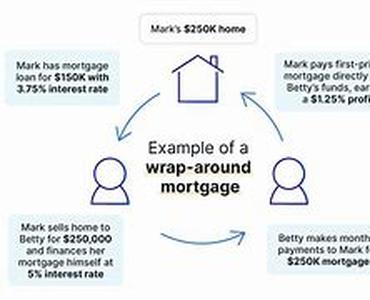

Secondary Keywords-credit , Customer , Finance , Payment Page Title- Tips To Make Decision About Giving Credit To CustomersSub TitleGiving Credit Tips To Make Decision About Giving Credit To Customers If You Are Deciding To Give Credit To Your Customers Then You Should Take Into Account Some Considerations To See Whether It Is Your Right Decision Or Not. Offering Credit Facility To Customers Can Effect Very Badly If You Dont Judge The Whole Financial Position Of Your Concern At First. It Is Always Proved As Risky But If You Get The Right Trick Then It Can Be Much Fruitful For Your Business. Giving Credit Facility To Your Customers Means That You Are Taking The Risk Of Being Paid In Future. It Can Be Uncertain Too. If You Make Any Quick Approach Over This Matter You Can Face Huge Lose Due To The Payment You Have To Make For The Goods You Are Selling In Credit. It Can Hamper Your Valuable Time, Which You Spend To Provide That Very Service And You Can Understand How Much Worthy The Time In Business Activities.Before Making Any Decision You Should Be Forward In Taking Possible Measures To Reduce Your Risk Involved In This Service So That It Cannot Hamper Your Profitability. Get Your Financial Structure Clear In Front Of Your Eyes And Then Evaluate The Risk In The Payment Procedure Of The Customers If You Provide Them Credit Facility And Also Decide How Much Level Of Risk You Can Have Without Any Trouble In Your Business Activities. If You Provide The Customers Credit Facility With Cash Payment, It Will Be To Some Extent Of Small Risk. In That Case You Should Be Concerned In Checking The Counterfoil Bills. You Can Take The Credit Cards For The Payments From The Debtors As Well. It Can Also Reduce The Risk To Some Extent If You Are Not Ignorant About The Procedure To Check The Signature And Expiration Dates Of The Credit Cards You Are Given. There Can Be The Case Of Fraudulent Or Stolen Credit Cards If You Dont Give Your Concern Into That Matter. Payment In Checks Can Be Safe Because Banks Are Involved In That.While Making Any Credit Agreement With The Customers You Need To Take Into All The Terms And Conditions Included In That Agreement And Those Should Be Clear To The Customers. It Should Be In Simple Language So That The Customers Get To Know The Credit Policy You Are Offering And That Can Remove The Complications. Also You Should Be Careful In Making Decision To Offer Credit Facility To Your Customers As It Can Make Bad Effect In The Relationship You Have With Your Customers. Dont Let It Be Hampered Because That Can Cause Disastrous To Your Business. If Possible Look Into The Customers Credit History And When It Is Not Possible Get An Idea Of Their Payment Ability.The Above Items Can Only Help You To Decide Your Credit Policies To The Customers But You Have To Remember That There Is No Such Rule That Can Reduce All The Risk Involved In This Matter, You Just Have To Follow Make Balancing Between Your Credit Facility And Your Profitability. Payment Procedure Should Be Selected According To Your Financial Position. To Make More Profit Dont Indulge Yourself In Taking A Huge Level Of Risk. Take The Risk To The Extent As Much As The Financial Position Allows You To Take. The Credit Application And Credit Agreement Should Be Signed And Be Filled Out. Dont Forget To Evaluate The Past Records Of Payment Of Your Respective Customers And Thus The Offer Of Credit Facility Can Definitely Prove To Be Beneficial To Your Business.