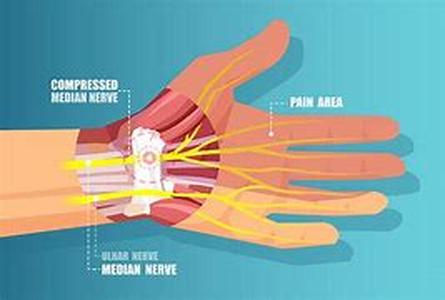

Did You Know That One Out Of Seven Americans May Get Into An Accident Or Develop An Illness That Would Prevent Them From Working Or Performing Their Occupation? There Is No Telling Whether You Will Be One Of The Lucky Ones Who Will Never Have To Worry About Income Stoppage On A Temporary Or Permanent Basis, Or Be Just Another Number In The Statistics. In Any Case, Purchasing An Individual Disability Insurance Policy Might Just Be What You Need To Give Yourself Some Peace Of Mind.What Is Individual Disability Insurance?Basically, An Individual Disability Insurance Policy Is One That Allows You To Still Earn A Portion Of Your Gross Income Should A Sickness Or Illness Prevents You From Working. It Is An Insurance Product That Will Support You For The Period Of Time During Which You Are Disabled And Unable To Work Or Perform What Is Required Of You In Your Own Occupation, Or Any Occupation For That Matter. What Does Individual Disability Insurance Cover?The Benefits You Receive From Your Individual Disability Insurance Will Cover Any Living Expenses You May Have, Including Your Monthly Bills, Mortgage And Car Payments, Groceries, And Other Daily Expenses. The Amount Of Monetary Benefits You Will Receive Depends On Your Insurance Company Or The Type Of Individual Disability Insurance You Decided To Purchase. Some Companies Provide Monthly Benefits While Others Provide A Bulk Amount Yearly. Your Individual Disability Insurance May Be Based On Your Salary, In Which Case It Will Either Comprise A Certain Portion Of Your Monthly Wage, Usually Ranging From 40 To 65. Other Individual Disability Insurance Packages May Provide A Specific Fixed Amount, Such As 5,000 A Month. Choosing The Right PolicyDifferent Companies Offer Different Insurance Packages For Individual Disability Under Different Terms And Conditions. Because Of The Wide Variety Of Individual Disability Insurance Policies Available, It Usually Takes More Than Just Looking For The Most Competitive Rate When It Comes To Choosing The Right Package For You.Rather, The First Thing You Should Consider Is How Your Insurance Company Defines Disability Under The Policy Offered. There Are Two Basic Types Of Disabilities And Your Individual Disability Insurance May Be Based On Any Of These Definitions: Own Occupation. Under This Type Of Individual Disability Insurance, Disability Means The Inability To Perform The Material And Substantial Duties Of Your Regular Occupation. The Keyword Here Is Regular Occupation, As Opposed To Any Occupation Which Is Covered Under The Next Type. Any Occupation (Gainful Occupation). Under This Individual Disability Insurance Policy, The Disability Contemplates An Injury Or Illness That Prevents You From Earning Income From Performing Your Regular Occupation Or Any Other Occupation Which You Would Have Been Qualified By Reason Of Your Education, Training, And Skills.