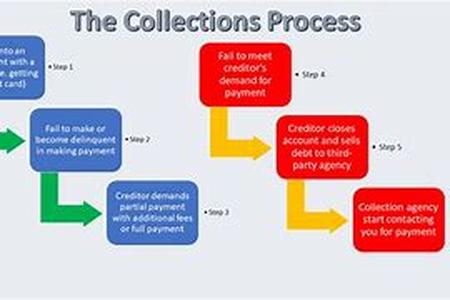

The Adventure Begins. As You Enter Into A Loan Process, Be Diligent In Expressing Yourconcerns With Questions You Need Answers To. Fining Out Your Plans, And The Resultsyou Want From Refinancing Your Home Is Our Beginning Point. You Went Through A Long Drawn Out Process Of Paperwork Here - Paperwork There In Buying Your Home. In Refinancing, Its Not That Drastic Because You Have Establishedyourself As A Home Owner.Helping You Get Those Results, We Discuss Your Consumer History (credit Report). Itsthe Primary Source Of Direction You Go Through In The Details Of Your New Homemortgage Program. Important Items That You Provide Are Used In The Pre-qualificationsteps As Your Loan Request Package Is Put Together.Your Consumer History Report Shows A Lot About How You Manage Your Spending Income. Scores Are Assigned By The Credit Bureaus Based Upon Their Grading Principles From 350 To 800. They Receive Reports From Almost Every Kind Of Lenderwhether A Department Store, An Auto Loan, To A Doctor Expense. The Percentage Ofconsumers Who Experience Bumps On Their Credit Is Very High. Its How You Handlethe Bumps That Counts The Most In Your Score.Having The Report, Gathering Important Documents Like Pay Stubs, W-2s, Bankstatements, Mortgage Statements, Home Owners Insurance Policy Coverage,1040 Tax Returns, And So Forth Are Reviewed For Stability, Verification, And Usagein The Loan Obtaining Process. When All The Items Are In Hand, We Then Discuss Your Loan Request Package Withdifferent Mortgage Lenders Who Will Accept Your Middle Consumer History Score, Your Income, Work History, Mortgage History Among Other Items In Your Request.We Establish The Different Loan Programs Available To Your Qualifications And Needsfor A Loan Period Of 2-50 Years, Loan Rate, Loan Payment Choices, Establishing Of An Escrow Account, Return Of Home Equity, Consolidation Of Consumer Debts Etc.Keeping In Mind, That All Of The Program Characteristics Most Meet Or Establish Afinancial Goal To Help You Improve Your Lifestyle. Debts Are The Down Side Of Havingfinancial Freedom. Helping You Understand The Importance Of Having Excellentconsumer History And Maintaining It Is A Personal Goal Of Mine.