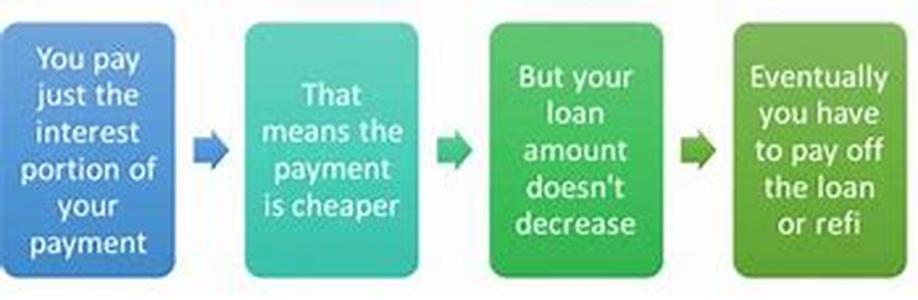

Interest Only Mortgages Is A Risky Product And Does Have Its Disadvantages.Interest Only Mortgages Are Tricky, Because They Can Be Misleading As Thepayment Is Very Small For The First 1,2,5,7 Or Even 10 Years. Note That For TheInterest Only Mortgage You Will Have A Balloon Payment For The Entire Principalbalance At The End Of The Loan Term.Interest Only Mortgages Might Be Beneficial For People In Markets Where Housesappreciate Rapidly And The Plan Is To Remain In The House For Only A Couple Ofyears. Interest Only Mortgages Are Available In Both Fixed Rate And Adjustablerate Varieties, But Most Interest Only Mortgages Are Of The Adjustable Ratevariety. Since Only An Interest Payment Is Due, Interest Only Mortgagesusually Have A Lower Monthly Mortgage Payment Than Mortgages That Requireprincipal And Interest Payments. For Example, If You Have Taken An Interestonly Mortgage Loan For 5 Years You Only Pay The Interest On Your Mortgage For 5years. The Interest Only Mortgage Rate Is An Adjustable Rate Determined By Thecurrent Interest Rate. This Preset Margin Will Stay Fixed Throughout Theremaining Term Of The Loan While The Interest Only Mortgage Rate Added To Itwill Change (generally On An Annual Basis) With The Fluctuation Of The Currentindex Rate. So After The Interest Only Mortgage Payment Period Is Over Youwill Be Paying The Adjusted Interest Only Mortgage Rate And The Principal,which Will Increase Your Interest Only Mortgage Payments. Interest Only Mortgages Usually Have An Interest Only Payment Option During Thefirst 1, 3, 5, 7, Or 10 Years Of The Mortgage. Interest Only Mortgage Paymentdoes Not Mean Negative Amortization. Interest Only Mortgage Payment Loans Aregenerally Not Long Term Solutions. Interest Only Loans For A Fixed Period Oftime. Interest-only Loans Are The Latest Tool Aimed At Offsetting High Homeprices. Interest-only Loans Represent A Somewhat Higher Risk For Lenders, Andtherefore Are Subject To A Slightly Higher Interest Rate. Interest-only Loansare Popular Ways Of Borrowing Money To Buy An Asset That Is Unlikely Todepreciate Much And Which Can Be Sold At The End Of The Loan To Repay Thecapital. Interest-only Loans Helped Homeowners Afford More Home And Earn Moreappreciation During This Time Period. Interest-only Loans May Turn Out To Bebad Financial Decisions If Housing Prices Drop, Causing Those Borrowers Tocarry A Mortgage Larger Than The Value Of The House, Which In Turn Will Make Itimpossible To Refinance The House Into A Fixed-rate Mortgage. It Is Important To Keep In Mind The Nature Of Interest Only Mortgages."Although Interest Only Mortgages Play A Vital Part In The Mortgage Industry,often Providing The Only Means For First Time Buyers To Hold The Key To Theirown Front Door, Misusing This Type Of Loan Is Counter-productive. A Sample Ofthe 3 Payment Options On A Loan Amount Of 250,000 Would Be:Minimum Amount Due804, Interest Only Mortgage 989, 30 Year Payment 1304, 15 Year Payment. Insummary, An Interest Only Mortgage Loan Can Save You Thousands Of Dollars Andpossibly Earn You Thousands More With The Right Diversified Investments Overtime. An Interest Only Mortgage Loan Gives People The Tools Necessary Tomanage Their Debts As Carefully As They Manage Their Assets. 30 Year Interestonly Mortgages Typically Come With A Ten Year (often Referred To As A 3010year Interest Only Loan) Or Fifteen Year Fixed (3015) Interest Only Period.Best For People Who: Are Very Focused On Money Management Want To Reducetheir Monthly Mortgage Payment Do Not Intend To Be In Their Homes More Than Afew Years Interest Only Mortgages And Loans As The Name Suggests, Means You Payinterest Only For The First Three, Five, Seven, Ten Years Of The Loan, Therebylowering Your Monthly Mortgage Payment By Quite A Lot.