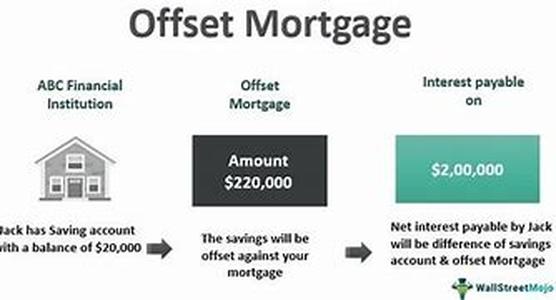

The Term Equity Value Is Often Used Synonymously With The Entire Equity Of A Given Home Loan.When Homeowners Consider Equity Loans, The Lender Will Consider The Equity Built In The Home. If Thehome Is Not Worth The Amount Applied For, The Homeowner Will Pay Higher Rates Of Interest Andmortgage Payments. Thus, The Equity If Negative Is Considered A Higher Risk Than Positive Equity.Still, The Equity Is Factored By Current Market Value, Value Of The Home, And So Forth To Determine Therisks. Lenders Put Risk First Often Since Large Sums Of Cash Are Involved. First Time Buyers Are Offeredvarious Types Of Loans, But Are Often High-risk Candidates Simply Because Equity Is Non-existing Untilthe Closing Is Final. First Time Buyers Searching For Home Loans Will Be Rated By Their Credit History,employment, Age, Gender, The Area Considered To Reside In, And So Forth. If The Buyer Has Excellentcredit, This Is A Plus To The Lender. The Lender Will Often Help The Borrower By Finding Adequate Rates Of Interest And May Even Suggest Aloan That Would Benefit The Borrower Moreso Than Other Loans. Thus, When Equity Exists, This Takes Abit Of The Load Off The Lender; However, If The Home Has Negative Equity, Then The Lender Isthreatened. Therefore, If The Lender Suggests That Your Home Has Negative Equity, You May Want To Request Asurveyor To Test The Homes Value To Confirm That The Lender Is Realistic. The Surveyor Will Help You Todetermine The Equity On Your Home, And If Negative Equity Exist Due To A Drop In Market Value, Youmay Want To Negotiate With The Lender, However, If Negative Equity Exists Due To Structural Damage,mites, Or Other Damage To The Property, You May Want To Consider A Different Amount Of Loan Toborrow.