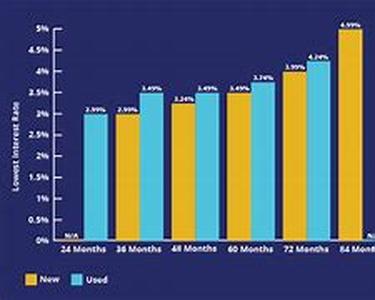

Are You A First-time Buyer Looking For Someone To Finance Your New Set Of Wheels? Well, Before You Go Ahead And Apply For A Car Loan, There Are A Few Things You Need To Keep In Mind. Scroll Down Below For Some Tips On How To Get The Best Car Loan Deal, Even If You're A First-time Buyer.First-time Buyer Car Loan: Steps To Take Before You Apply For New Car LoansIf You're A First-time Buyer, The First Step You Need To Take Before Applying For A Car Loan Is To Get Your Credit Score. For Around 9, You Can Get A Copy Of Your Credit Report From Any Of The Following Online Credit Agencies - Equifax, Experian, Or TrueCredit. Getting A Copy Of Your Credit Score Before You Apply For A First-time Buyer Car Loan Can Help Prevent You From Getting Ripped Off By Dealers Who Lie To You About Your Score And Then Charge You Higher-than-normal Interest Rates. Purchasing Your Own Credit Report Is Especially Important To First-time Buyers Who, Like You, Are Still Building Their Credits. It Is A Well-known Fact That The More Times Your Credit Report Is Pulled Out By A Dealer, The Greater The Chances That Your Credit Score Is Going To Drop. So If You Have Your Own Copy, You Can Just Fax That To Your Dealer And He No Longer Needs To Pull Out Your File In Order To Pre-approve You For A Car Loan.The Next Step In Car Loan Shopping Is One That Applies To All Kinds Of Customers, First-time Buyers Or Otherwise. Research Auto Loan Rates Through Online Financing Agencies Or Vehicle Lenders. Use Car Loan Payment Calculators To Compare These Rates And Find Out Which One Is Better.First-time Buyers Of Cars Should Remember That The Extent Of Checks That Car Loan Lending Institutions Make On Your Credit Is The Same As In Any Regular Loan Or Mortgage. Therefore, If You Want Speedy Approval, Close Your Old Credit Accounts. These Are Just Excess Baggage That Could Drag Down Your Credit Score. However, Leave Your Oldest Account Open.Before Applying For First-time Buyer Car Loans, Make Sure That You Remove Any Errors From Your Credit Report, Such As Previous Addresses And Other Such Errors. If You Want To Qualify For The Lowest Rate Car Loans, Wait Until Your Score Goes Up To 680. However, For First-time Buyers This Might Not Be An Easy Feat To Accomplish Since You Don't Have Enough Credit To Get That Kind Of Score. Even So, Try To Research And Get The Next Best Thing.First-time Buyers Car Loan: How To Increase Your Car Loan Approval ChancesIf You're A First-time Buyer, Say You're A Recent College Grad, Don't Apply For New Car Loans Until You're At Your New Job For At Least 6 Months. Remember That Employment Has A Huge Bearing On Your Chances Of Getting Approval For A Car Loan So The Longer You Are Employed At The Same Office, The Better It Would Be For You.For First-time Buyers, You Can Improve Your Approval Chances For A Car Loan If You Pay Down Your Credit Car Balances As Low As Possible. Before You Apply For First-time Buyer Car Loans, Pay Off Higher APR Cards, That Way, Your Credit Standing Would Look Good To The Lender.TOTAL WORD COUNT - 557KEYWORDS "Car Loan" - 19 (density 3.4) "First-time Buyer" - 15 (density 2.7)