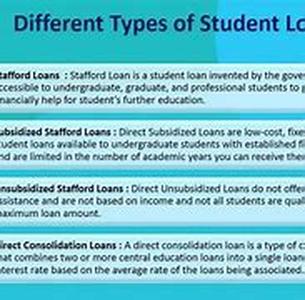

Source: Http:financeequityloans.comCategory: Student LoansArticle Body: For A Very Long Time Education Has Been An Aspired To And Sought After Achievement By Those Less Fortunate And As We Move Ahead In The Infancy Of The Twenty-first Century, The Greater The Need Becomes For A Higher, Broader, More Innovative And Flexible Qualification Span That Satisfies And Matches The Ever Increasing Job Market Demands. Competence Rules The Day And Young People More Than Ever Before, Are Forced To Focus On Planning Ahead Carefully For Their Academic And Income Oriented Future. To Study Well And Gain A Good Educational Basis Is A Necessary Ingredient In The World Today And Considered One Of The Most Important Decisions Of Our Lives. Indisputably A Degree Is Beneficial To Those Who Understand How To Implement It To Their Advantage And At Reasonable Cost.While Finding Out What Line Of Education To Follow, The Student Is Faced With Another Equally Important Issue That Has To Be Calculated. Educational Tuition Does Not Always Come At No Financial Cost And Unless The Student Has The Possibility To Pay For Tuition Via Family Or Job, They May Find Themselves Having To Start Student Life Off By Borrowing To Cover These Costs, Depending On Where The Student Is Geographically Located And What Line Of Education They Intend To Pursue.Naturally, Each Country Is Equipped With Their Own Practice And Generally Have Several Varying Opportunities Of Financial Assistance For Students Taking Higher Education. These Can Be In The Form Of Grants Or Subsidies, As Well As Governmental Student Loans And Loans Granted By Private Entities - All Subject To Varying Circumstances And Underlying Variables That Need To Be Taken Into Consideration.In Scandinavia For Example - I.e. Denmark, Sweden And Norway, Their Educational Loan Practices, While Not Totally The Same Are Similar To One Another; Student Grants And Loans Are Generally Administered By The Individual National Educational Ministry For Grants And Loans. Students Of Eighteen Years Of Age And Above Are Entitled To A Free Grant Which Is Then Regulated In Part In Accordance With Their Parents Income If They Are Under The Age Of Twenty. This Means That A Student Of Between Eighteen And Twenty Years Of Age Would Receive A Grant Of A Certain Amount. However, If The Parents Have An Income Bracket That Is On A Higher Level, The Amount Of The Grant Given By The Educational Ministry Would Be Regulated Down To Where It Would Then Be The Parents Of The Student That Would Subsidise The Rest.The Practice Used For Students Living On Their Own, Who Are Older Than Twenty However, Is That They Receive A Grant Of Approximately Eight-hundred-fifty-dollars A Month And Where Necessary, The Student Is Permitted To Supplement This Amount With Additional Monies In The Form Of A Student Loan Of Approximately Fifty Percent Of The Actual Grant Amount, Which Must Be Repaid Upon Completion Of Their Education. So In Effect The Student Would Receive An Annual Amount Of Approximately Fifteen Thousand Dollars.While University And High School Entry And Tuition Is Free Of Charge In This Part Of The World, There Are Added Advantages In Europe Of Applying For Grants And Loans From The European Union. Approval For These Applications Would Depend On The Educational Line The Student Has Chosen, But There Is Very Wide Range Of Academic And Higher Education Topics For Enrollment To Consider. Even As A Part-time Or Handicapped Or Older Person - Student Subsidies, Grants And Loans Can Be Given. Qualification Would Depend On A Number Of Variables Such As; Where The Student Will Study (i.e. Which Country) The Amount Of Household Income, What Type Of Education Or Course Is Planned And So On.Additionally, Students Residing In European Union Member Countries Are Permitted To Apply For Enrollment To Other Member Country Universities Or Other Educational Institute. Cross-boarder Education Is Encouraged However, There Can Be Other Loan, Grant And Tuition Fee Rules That Need To Be Considered As Each Member Country Has Their Own Tuition Fee Practice. European Union Rules Stipulate, That Students From Any Member Country Are Entitled To The Same Help With Fees As Those In Their Home Country. Other, Non-EU Students Would Typically Have To Pay Much Higher Fees. However, Cross-boarder Education Can Be Very Rewarding Indeed For The Student And There Are Many Facilities Well Worth Considering.In Order To Survive The Day-to-day Aspects Of The Cost Of Living, Many Students Are Forced To Take A Job During Term. After Class There Are Possible Home-studies And Work-groups To Prepare For The Next Day Or Next Lesson So Jobs That Students Are Able To Overcome Time-wise Are Typically Working In Bars, Restaurants, Hotels And Retail Sectors. In The Hospitality Sector Students Can Earn A Fair Amount In Tips And These Help With Their Daily Costs, So Much So That Some Students Are Able To Save And Repay Any Student Loan They Have On Completion Of Their Studies, While Many Other Students For Various Reasons Are Not Able To Do This. However, In Some Cases And Loan Repayment Country Practice A Grace Period Is Granted For Student Loan Repayment Until Such Time As The Graduate Is Earning A Certain Amount. The Amount Will Vary From Country To Country And The Loan Arrangement Made At The Time, But On The Whole Repayment Terms Are Lenient.There Are Several Kinds Of Student Loans Available The World Over. Those That Seem Most Common In The US As Apposed To Those In Europe Are The Federal And Private Student Loans. The U.S. Department Of Education's Federal Student Aid Programs Manage The Federally Funded Loans. The Federal Educational Loan Is Probably One Of The Less Difficult To Obtain. Other Common Student Loan Programs Can Be Obtained Through One Or Two Major US Banks. While Private Student Loans Are Available And Are Typically Charged With A Higher Interest Rate As They Are Generally Unsecured.The Interest On Federal Loans Are Tax-deductible And In Some Cases It Isn't Necessary To Repay The Student Loan. There Are Many Kinds Of Student Debt Consolidation Plans Offered. However, The Majority Of Them Offer The Same Services. These Benefits Include Reducing The Size Of Monthly Payment, Lowering The Monthly Payment By A Certain Percentage And So On.Students Having Completed Their Education Who Are For Whatever Reason Unable To Repay Their Loans On Due Dates, Could Face Difficulties In Getting Credit In The Future. These Could Be Anything From Mortgages, Car Loans To Credit Cards, Or Similar. It Can Therefore Be An Advantage To Certain Extent To Consider Student Debt Consolidation Options That Are Available In Order To Avoid Negative Consequences Later In Life.Due To The Increasing Number Of Debt Consolidation Agencies Cropping Up World-wide, It's A Good Idea To Research Each Entity Before Entering Into Any Arrangement.