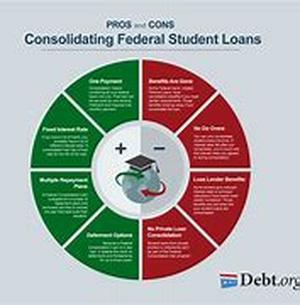

Source: Http:financeequityloans.comCategory: Student LoansArticle Body: In Our Increasing Competitive And Global Economy The Need For A Higher Education Is More Prominent Now Than Ever Before. Even The Most Basic Of Jobs Now Requires Some Type Of College Degree. Unfortunately, For Many The Cost Of A Degree Is Beyond Their Financial Means. A State University Nowadays Averages Almost 13,000 Per Year, With Most Degree Seekers Requiring At Least 4 Years Of Study Before Obtaining Their Degree. Without Outside Aid Of Some Sort The Prospect Of Getting A Degree, And The Job That Goes With It, Would Be Far Above The Means Of Many Of Us. However, There Is Hope In The Form Of Student Loans That Are Part Of The Federal Financial Aid Program.Student Loans Come In Three Primary Forms: Federal Perkins Loans, Federal Stafford Loans And Federal Parent Loans For Students (PLUS). Your Financial Need And Other Criteria Determine Which Of These Loans You Will Qualify For. In Addition, There Are Also So-called Private Education Loans That Are Offered By Numerous Banks And Other Financial Organizations That Are Not Part Of The Financial Aid Process.The Most Selective Type Of Loan That Is Distributed By Higher Education Institutions Is The Federal Perkins Loans. This Type Of Loan Is Awarded Based Solely On The Basis Of Financial Need And Is A Low-interest Loan That Is Fixed For The Entire Life Of The Loan. The Loan Has A Maximum Duration Of 10 Years And As Long As The Student Is In School They Will Pay No Interest On The Loan. Each College Or University Only Has A Select Amount Of Money Set Aside For These Types Of Loans And As A Result They Are Handed Out Very Selectively After Other Sources Of Financial Aid Have Been Exhausted. The Minimum Loan Amount Is 4,000 With A Maximum Of 20,000 Per Year For Undergraduates. The Loans Themselves Are Serviced Directly By The Federal Government.Federal Stafford Loans Are The Most Common Type Of Loans Awarded To Students And Come In Two Varieties, Subsidized And Unsubsidized. Subsidized Loans Are Awarded On The Basis Of Financial Need And Are Tiered, With The Maximum Amount Increasing Depending On What Year In School The Student Is Currently In. As Long As The Student Is In School, Or In A Deferment Period, The Federal Government Pays The Interest On The Subsidized Loan. These Loans Are Services By Participating Banks And Other Financial Institutions, Guaranteed By The Government. Interest Rates On These Loans Are Determined By T-Bill Rates And Are Set Once A Year Before Disbursement For The Upcoming School Year Begins.Unsubsidized Stafford Loans Are Not A Need-based Award. The Borrower Is Directly Responsible For The Interest On The Loan Beginning With The First Date Of Disbursement. Other Than The Interest Rate, The Same Rules And Limits That Apply To Subsidized Loans Apply To Unsubsidized Loans.Frequently Parents Are Expected To Contribute Some Amount Towards A Childs Higher Education Depending On Their Financial Situation. However, Recognizing That Many Families Simply Cannot Afford To Make Such Payments There Is A Third Type Of Loan That Is Geared Specifically Towards Parents And Helping Them Pay For Their Portion The Federal Parent Loans For Students (PLUS). A PLUS Loan Will Cover The Entire Portion Of The Parents Expected Contribution And Is Guaranteed By The Federal Government, But Is Issued By Participating Financial Agencies. With This Type Of Loan There Is No Income Or Asset Requirements Making It Accessible To Even Those Families With Modest Means. The Interest Rate Is Generally Lower Than Most Standard Loan Types (around 6) And There Are A Number Of Repayment Options Available, Including Plans For Those With Limited Incomes And A Deferred Payment Plan While The Child Is Still In School.The Bright Future That A Higher Education Can Bring Can Sometimes Seem A Distant Hope For Many. However, With The Variety Of Student Loan Programs Available Out There Today Even The Most Modest Of Families Can Help Their Child Get The Education They Need To Get Ahead In Todays World.? Studentloansdot.com