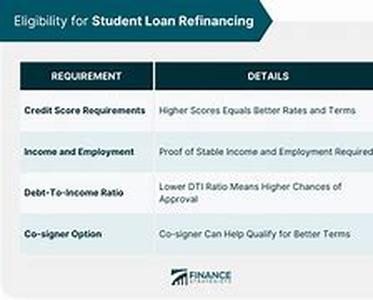

Source: Http:financeequityloans.comCategory: Student LoansArticle Body: Student Loan Consolidation Is An Effective Solution For Those Students Who Are Having Difficulties Keeping Up With The Payments Of All Of Their Monthly Student Loans.Paying For Your Student Loans Is More Organized, And Manageable With Student Loan Consolidation. It Also Allows You To Save Some Money, Because Consolidating All Of Your Student Loans Lower Your Interest Rate.The Public Interest Research Group In The US Say That The Average Debt Among Student Borrowers Is Currently In Excess Of 16,500. The Associated Press Also Noted That Graduates Of Public Colleges And Universities Usually Emerge Owing More Than 10,000 For Their Undergraduate Years Alone. Those Who Are In Private Institutions Typically Owe 14,000, While The Graduate-level Students Often Owe More Than 24,000. This Has Become A Real Issue For Anyone Starting Out In Life With A Large Debt Burden.As You All Know, The Repayment Of Ample Student Loans Can Be A Real Hassle For Both Students And Their Parents.Student Loan Consolidation Is A Payment Plan That Combines All Of Your Loans Into A Single Loan. This Way, Individuals Who Are Paying For Multiple Loans Would Only Have To Worry About Making A Single Payment To A Single Lender.The Big Issue Is That Repaying These Debts Has Become More Difficult For Graduates In The Midst Of Uncertain Jobs.There Is No Payment Fee Required To Have You Student Loans Consolidated. The Procedure Of Applying For A Student Loan Consolidation Is Very Simple.Lending Institutions Vary In Their Requirements And Specifications For Eligibility. Some Of The Information That Is Usually Asked For Is, Personal Information, List Of Loans, Contact Information, Etc.Those Who Are Thinking Of Applying For A Student Loan Consolidation Should Also Look For A Lending Institution That Offers An Arrangement That's Most Suited For Their Needs. Plus, It Would Not Hurt To Compare Interest Rates To Get The Best Deal.Applicants For Student Loan Consolidation Would Have To Continue Paying For Their Existing Loans While They Are Still Waiting For Their Applications To Get Processed. Students Can Even Apply Online.Once They Have Been Accepted They Would Receive A Notification Email That Relates To All Of The Necessary Information That They Need, Such As: Schedules And Details About The Payment Plan.Students Can Always Seek Out The Assistance Of A Loan Councilor To Get The Advice And Evaluation Of A Loan Expert. This Way, They Would Be Able To Discuss And Ask Questions Pertaining Specifically To Their Case.There Is One Particular Truth When It Comes To Student Loans You Cant Hide From Them. It May Sound Extreme Though, But School Loans Are Completely Immune To Bankruptcy And Those Students Or Graduates That Failed To Pay Their Bills Face Stiff Punishments. The Usual Consequences Are Poor Credit Ratings, Garnishment Of Wages, And IRS Penalties.Besides, Attaining Licenses In Certain Fields Is Impossible When You Failed To Pay Off Your Student Loan Debts. There Is Even A Chance That You May Be Excluded From Some Government Contracts If You Own A Small Business. With All These Consequences, It Is Then Clear That Avoiding A Student Loan Is No Way To Start A Life After College.In The End, About Half Of The Students Coming Out Of College Have Actually Gained Their Degrees. Of Course, It Can Be Tough To Remain And Stay In School With Financial Burdens, And It Is Harder To Come Back. But, Thanks To Student Loan Consolidation That Creating One Less Barrier To Coming Back To School And Keeping Your Credit Rating Clean Is Now Possible.In The Government Consolidation Loan Programs, It Is Interesting To Know That There Are Actually No Deadlines Connected To Them. It Is Supported By The Fact That You Can Apply For The Student Loan Anytime During The Grace Period Or Even On The Repayment Period. But To Consolidate Student Loans, There Are Considerations That You Have To Deal With.To Consolidate Student Loans, You Should Know That It Usually Take Place During Your Grace Period. At This Moment, The Lower In-school Interest Rate Will Then Be Applied To Estimate The Weighted Average Fixed Rate To Consolidate Student Loans. And Once The Grace Period Has Ended On Your Government Student Loans, The Higher In-repayment Interest Rate Will Be Applied To Estimate The Weighted Average Fixed Rate. Given Such Process, It Is Then Understandable That Your Fixed Interest Rate For Government Student Loan Consolidation Will Be Higher If You Consolidate Student Loans After Your Grace Period.Student Loan Consolidation Is A Great Payment Plan That Helps Individuals Pay For Their Educational Loans. This Is Something That Should Be Looked Into By Students Who Are Having Difficulties Keeping Up, And Paying All Of Their Student Loans.Student Loan Consolidation Just Might Be The Effective Solution To Your Financial Problems.