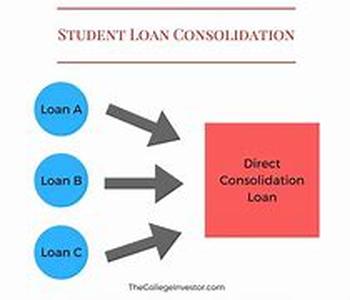

Source: Http:financeequityloans.comCategory: Student LoansArticle Body: If You Have Just Gotten Out Of College And You Are Looking For Ways To Reduce Your Mounting Student Loans, Then You Might Want To Consider Student Loan Consolidation. Student Loan Consolidation Is A Great Way Of Managing Your Finances And Your Loans Right After You Have Completed Schooling. With This Type Of Loan Consolidation, Private And Federal Loans Could Be Combined Under One, Convenient Monthly Payment.Student Loan Debt Consolidation Comes In Lower Monthly Payments As Compared To Two Or More Separate Loans. The Standard Period Of Payment Is Set At Ten Years. For Those Who Are Considering Of Consolidating Their Student Loans, The Following Institutions Could Provide The Consolidation Loan: Banks, Credit Unions, Secondary Markets And Other Lenders-this Is All According To The FFEL Or Federal Family Education Loan Program.Which Loans Are Eligible For Consolidation?The Eligible Education Loans That Can Be Included In A Student Loan Debt Consolidation Scheme Are Those That Are Subsidized By SLS, Federal Perkins Loans, FFEL Stafford Loans, Federal Nursing Loans, And Health Education Assistance Loans.Private Education Loans, On The Other Hand, Cannot Be Included In A Student Loan Debt Consolidation. For Further Details On Which Student Loans Can Be Included In The Student Loan Debt Consolidation, You Could Try To Contact Direct Loan Origination Center (look For The Consolidation Department). For Those Who Are Trying To Apply For An FFEL Student Loan Debt Consolidation, An FFEL Lender Would Be The Best Person Who Could Help.Students Who Have Already Graduated From School Are Still Eligible For A Student Loan Debt Consolidation Loan. Even Those Who Have Dropped Out Of School Or Just Plainly Left Could Still Be Eligible For This Type Of Consolidation Loan. Those Who Are Still In The Middle Of Schooling Could Also Apply For This Consolidation Loan.The Only Requirement Is This: You Should Have Attended At Least Half Of The School Year And Have At Least 1 FFEL Or Direct Loan During The School Season. This Simply Means Continuous Enrollment For At Least Half Of The Time That The Loan Has Been Paid Out.Tips On Student Loan Debt ConsolidationIf You Have A Similar Holder For All The FFEL Loans That You Need To Consolidate, You Must Get The Student Loan Debt Consolidation Loan From That Same Holder. This Is Not Applicable, Though, If You Were Not Able To Obtain A Loan With Suitable Income-sensitive Repayment Terms.For Instance, A William D. Ford Direct Loan For Student Loan Debt Consolidation Cannot Be Obtained Unless You Have Either A Direct Stafford Subsidized Or Unsubsidized Loan; Or At Least A Single FFEL Program, Stafford Subsidized Or Unsubsidized Loan.Be Well-informed When You Are Securing A Student Loan Consolidation And You Will Eventually Reap The Rewards. If You Are At Peace With Your Financial Life, You Will Live To Enjoy Other Aspects Of Your Life.