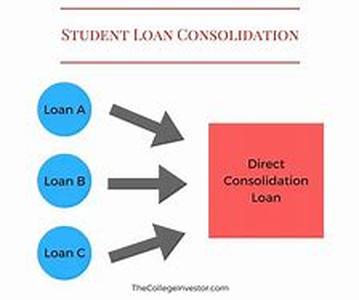

Source: Http:financeequityloans.comCategory: Student LoansArticle Body: Many Students Are Awarded All Types Of Financial Aid And Student Loans That Cover Tuition. Unfortunately, College Costs Can Far Exceed The Price Of Your Class. Private Student Loans, Or Alternative Loans, Can Help To Bridge The Gap Between Your Financial Aid, Scholarships And Living Expenses.Private Student Loans Can Be Used For Just About Anything That You Need While You Are In School. You Can Use Them For A Laptop, Car, Food, And Gasoline, Whatever You Need While You Are In School. Many Private Student Loans Will Allow You To Defer Payments On The Loan Until After Graduation. This Can Be A Big Help When It Comes To Getting Yourself Through School.You Will Need To Do Some Comparison Shopping Before You Apply For A Private Student Loan. Compare Rates, Terms, Perks And Fees Before You Fill Out An Application. Some Loans May Require A Hefty Origination Fee. Some May Not Offer Deferred Payments. Some Will Offer Specials Circumstance Leeway With Payments For Future Times Of Need. Educate Yourself On The Types Of Benefits You Can Receive From Different Types Of Private Student Loans Before You Apply.Some Students May Get The Idea To Apply For As Many Loans As Possible Instead Of Doing The Legwork And Figuring Out Which Private Student Loan Is Best Before Applying. This Can Be Detrimental To Your Cause. This Is Because Each Application You Put In Reflects As A Credit Inquiry On Your Credit Report, And Can Affect Your Credit Rating. Your Credit Rating Will Determine Whether Or Not You Qualify For Those Better Loans. So, Do Not Jump The Gun And Just Start Filling Out Random Applications, Shop Around And Compare Lenders Before You Commit.Once You Have Your Loan, Stick To Making Payments On Time, Every Time To Protect Your Credit. Paying A Loan On Time Can Really Help Your Credit Score. Paying More Than The Minimum Is Also Helpful. If You Ever Anticipate Not Being Able To Make A Payment, Call Your Lender Right Away. Keep In Touch With Them And Make A Concerted Effort To Resolve The Situation. This Could Mean The Difference In Having A Bad Hit On Your Credit Or Keeping It Blemish Free. Do Not Ever Blow Off A Loan Payment. Every Late Payment Goes On Your Credit. It Can Also Cause You To Lose Good Interest Rates Or Other Benefits.Some Private Student Loan Lenders Offer Special Reduced Rates To Customers That Make On Time Payments For An Extended Period Of Time. One Late Payment Could Count You Out Of This Special Deal And Could Even Cause Your Rate To Increase.Be Wise And Educate Yourself About Private Student Loans Before You Sign On The Dotted Line. Make Sure That You Know Exactly How The Payment Plan Works And Work Towards The Goals Of Better Rates And Special Deals. Keep Your Payments On Time And Your Credit In Check.